The carbon credit market is a crucial tool in achieving global climate change goals, providing nations and businesses with the means to transition to low-carbon fuels and efficiently reach Net-zero emission target.

With the establishment of the United Nations Framework Convention on Climate Change (UNFCCC) in 1992, nations acknowledged the collective concern about the adverse impacts of climate change. 196 countries signed the convention, reflecting global efforts to combat climate change and reduce greenhouse gas emissions worldwide.

Annually, around 51 billion tons of greenhouse gases (GHGs) are emitted globally into the atmosphere. To mitigate the negative effects of climate change, it is imperative to reduce this figure to net-zero within the next 30 years (by 2050). This poses one of the most challenging tasks, requiring direct involvement and substantial investments from the community, particularly the private sector, in innovative technologies to reduce carbon emissions in the production, distribution, and supply chain processes.

The carbon credit market emerges as a crucial tool to achieve global climate change goals, especially in the medium and long term. It provides resources and reduces costs, enabling nations and businesses to transition to low-carbon fuels and efficiently reach net-zero emission targets

So, what is the carbon market? How are carbon credits understood?

The carbon market is established by climate policies or climate goals of one or multiple countries/organizations through the trading of greenhouse gas (GHG) emission allowances or recognized emission reductions in the form of carbon credits. This provides options for meeting emission reduction targets as required or voluntarily.

According to McKinsey Sustainability, a carbon credit is a certificate representing one ton of carbon dioxide, or an equivalent ton of other greenhouse gases converted to one ton of CO2 equivalent. It is used to prevent emissions into the atmosphere or remove them through a carbon reduction project.

To generate carbon credits through a carbon reduction project, the entity must demonstrate that the emission reduction or removal of carbon dioxide is real, measurable, permanent, additional, independently verified, unique, and compliant with international legal mechanisms.

According to Decision No. 01/2022/QĐ-TTg issued by the Prime Minister, concerning the participants in the domestic carbon market, it is evident that the entities most significantly affected by their involvement in this market are large greenhouse gas emitters. (Policy Brief No. 33, 2023 – Center for People and Nature)

Benefits

Participating in the carbon market brings about certain benefits for businesses:

- Investing in advanced, energy-efficient, and low-emission technologies.

- Generating additional revenue from trading emission allowances or carbon credits.

- Establishing a basis for ensuring benefits, enhancing reputation, and increasing competitiveness when participating in markets applying carbon pricing mechanisms.

- Contributing to national and global greenhouse gas emission reduction goals.

Challenges

However, to achieve the goal of reducing greenhouse gas emissions, businesses need to be cautious and confront the challenges posed to participants in the carbon market:

- Directly impacting production capabilities.

- Facing pressure to adopt low-emission technologies to comply with legal regulations.

- Diminished brand reputation and competitiveness if emission levels fall below allocated limits are not ensured.

Classification of the carbon market

According to the Food and Agriculture Organization (FAO), the carbon market comprises the mandatory carbon market (compliance market) and the voluntary carbon market.

The mandatory carbon market is a market where countries, organizations, or businesses are legally required to inventory and reduce their greenhouse gas (GHG) emissions. They have the right to participate in activities such as emissions trading, buying and selling, and transferring GHG emission allowances, as well as carbon credits. Emission reduction activities must comply with the mandatory regulations set by the country, region, or international agreements, such as mechanisms under the Kyoto Protocol (KP), the European Emissions Trading System/Scheme (EU-ETS), and other mandatory emissions trading systems.

In contrast, the voluntary carbon market is a market that allows emitting entities to offset their unavoidable emissions by purchasing carbon credits generated from voluntary emission reduction projects. These projects adhere to voluntary/independent carbon standards such as the Verified Carbon Standard (VCS) or the Gold Standard (GS) and other voluntary carbon standards.

Carbon Pricing Tools

Carbon pricing is a mechanism where costs and damages from greenhouse gas emissions are assessed. This price is typically set per ton of carbon dioxide equivalent (CO2e). Key carbon pricing instruments include:

- Carbon Tax: The government sets a fixed tax rate that emission sources must pay for each ton of greenhouse gas (GHG) emissions they release into the atmosphere. The carbon tax is introduced by the government with a predetermined price and a schedule for tax increases, as well as clearly defined rate adjustment rules.

- Emission Trading System (ETS): This is a system established by the government to limit emissions for regulated emission sources managed by ETS through the allocation of GHG emission allowances. Emission sources managed by ETS have the right to trade, exchange emission allowances, offset emissions by purchasing government-recognized carbon credits, and implement internal GHG emission reduction measures.

- Carbon Offsetting Mechanism: This mechanism involves registering and implementing programs and projects for reducing greenhouse gas emissions and generating carbon credits according to internationally or domestically recognized methods in Vietnam.

The global implementation status of the carbon market

According to Global Market Insights, the global carbon credits reached a value of $87.9 billion in 2022 and are expected to grow with a Compound Annual Growth Rate (CAGR) of 14.2% from 2023 to 2032. It is estimated that trading carbon credits could reduce over half of the deployment costs of countries’ Nationally Determined Contributions (NDCs) – up to $250 billion by 2030. In other words, carbon credit trading could help eliminate more than 50% of emissions (about 5 gigatons of CO2 per year by 2030) without additional costs.

For decades, the carbon market has been considered part of the solution to climate change. Over two-thirds of countries are planning to use the carbon market to meet their Nationally Determined Contributions (NDCs) under the Paris Agreement. (Countries on the Cusp of Carbon Markets, World Bank)

Established in 2005, the European Union Emissions Trading System (EU ETS) is the world’s largest carbon market, covering about 45% of the carbon emissions in the European Union from over 11,000 entities. The European carbon credit market accounted for approximately 76.1% of the revenue share in 2022.

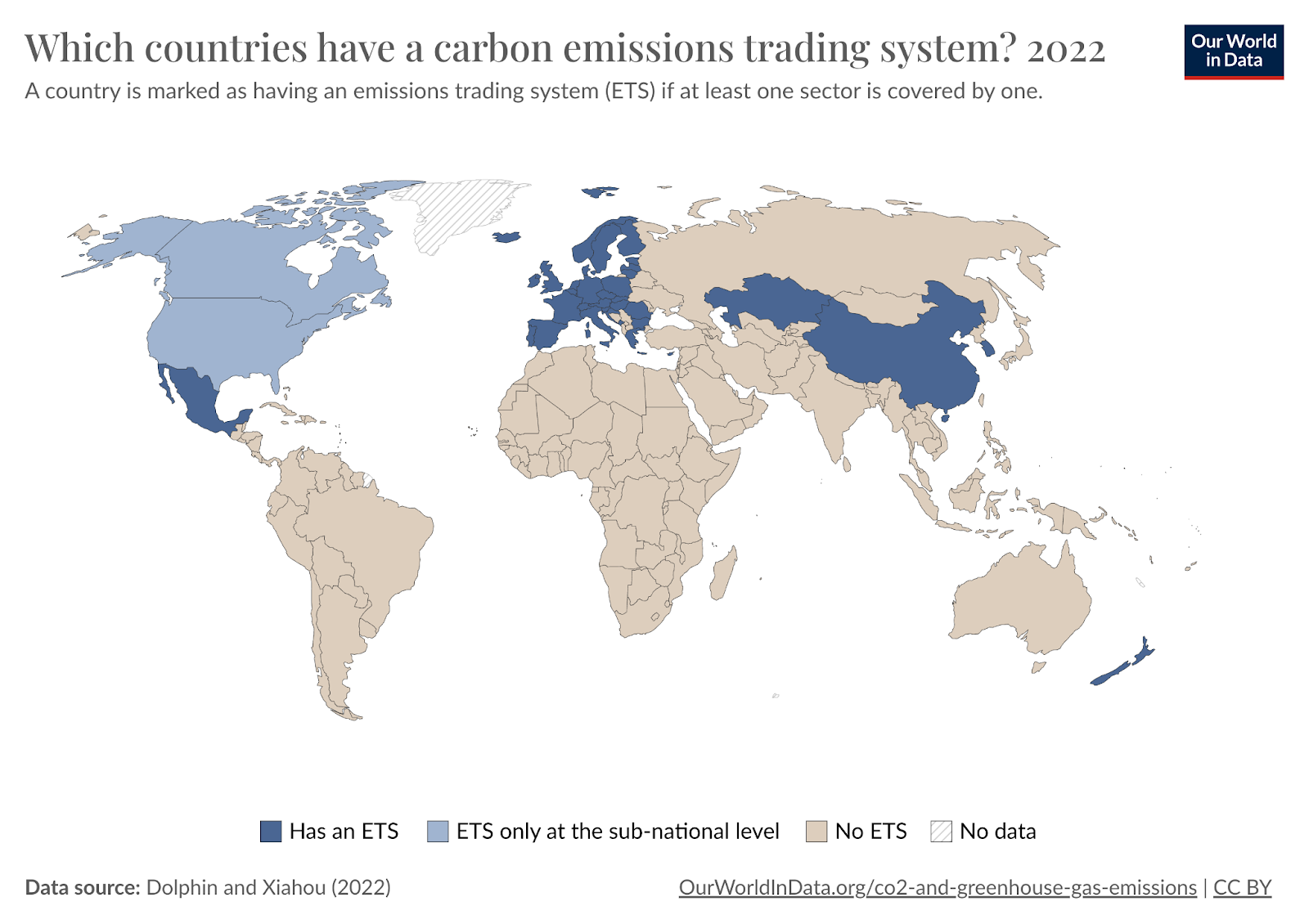

In addition to the EU ETS, national or subnational systems are operational or under development in Canada, China, Japan, New Zealand, South Korea, Switzerland, and the United States.

From 2014-2017, the European Commission closely collaborated with China, implementing a 3-year project to support the design and implementation of the emissions trading system in China. By 2021, China’s ETS became operational.

South Korea’s Emissions Trading System (KETS), launched in 2015, covers about 66% of the total greenhouse gas emissions in South Korea. Switzerland’s Emissions Trading System (Swiss ETS), introduced in 2008, accounts for approximately 12% of the country’s total greenhouse gas emissions in 2020.

Southeast Asia holds one of the world’s most valuable carbon reservoirs. Economies like Indonesia, Malaysia, and Thailand currently possess significant carbon reserves, and local authorities in the region are taking steps to establish both voluntary and compliance markets locally.